SAVILLS research shows prague office market fairly priced as Czechia remains regional investment haven

According to Savills latest research, Prague’s office real estate market is fairly priced despite some minor outward prime yield movement during the first half of the year. This broader continent-wide outward yield movement has helped push the average yield spread between prime European offices and Eurozone government bonds to 325 basis points, more than 100 bps above the historic average.

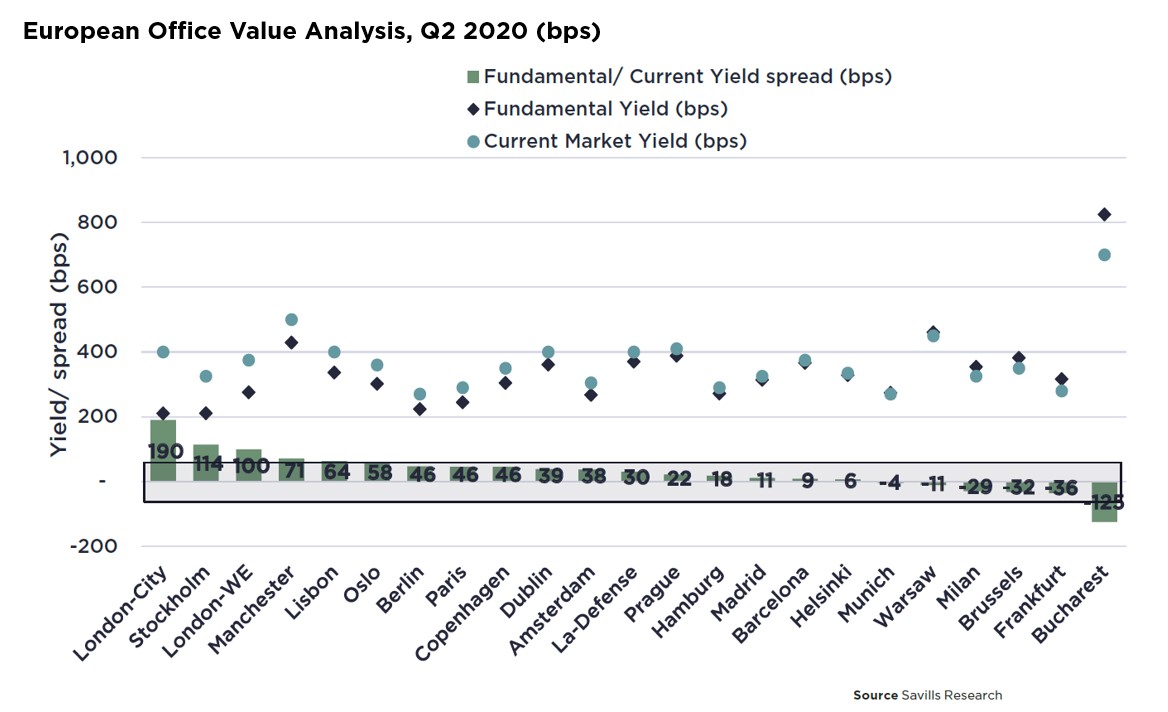

An investor must be compensated for bearing the risk of investing in real estate over sovereign bonds, the “risk-free” rate, which factors in future real rental growth and depreciation. Savills European Office Yield Analysis adopts a methodology that assesses prime ‘fundamental’ office pricing relative to market pricing across 23 European markets, including Prague.

The latest European Office Yield Analysis, released in October, showed that the majority (15 of 23) of Europe’s office markets appeared fairly priced at the end of Q2 2020, despite more limited rental growth prospects. Record low sovereign bond yields will continue to maintain the appeal of prime offices as an investment, as multiasset managers seek to increase their exposure to real estate.

Prague’s low office vacancy rate of 6.1%, its supressed supply pipeline and its liquidity amongst institutional investors provide a significant de-risking.

“This research clearly demonstrates that Prague’s prime office stock is fairly priced, with an argument that yields could even compress slightly. Savills research shows that Prague’s current prime yield of 4.10% is 22 bps above its fundamental yield. The city, and country, remain a regional investment safe haven with continued strong underlying market fundamentals,” says Fraser Watson, Director - Investment Advisory, Savills Czech & Slovak Republics. “In this era of low return fixed-income instruments, we see that Prague’s office market risk-adjusted return profile will continue to appeal to investors.”