Flexible Working on Rise Says JLL & Skanska Report FLEXcellent Working

The pandemic has been changing the office sector around the world and global uncertainty has meant that more attention is now focused on flexible solutions. JLL and Skanska predict that 30% of office space is expected to be utilised on a flexible basis by 2030.

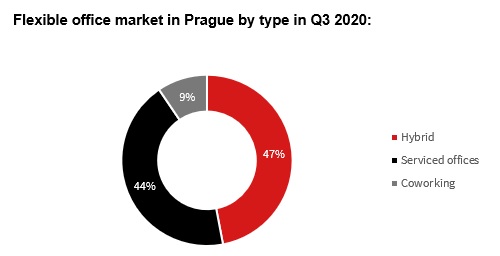

With a global annual average growth rate of 25% since 2014, the flexible space sector has become a significant component of the office market in many cities. Flexible offices and solutions are divided into three types:

- serviced flex offices (usually 90% private offices)

- coworking spaces (up to 80 % open plan office)

- hybrid offices (80% private offices and 20% coworking space) that are most frequent across Europe now.

Although the Covid-19 pandemic has tested financial strength of many flex office operators so far, the future of this sector seems to be bright. The interest in more agile real estate solutions and a potential decline in demand for long-term lease contracts will mean that the market will increasingly turn to flexible spaces, according to the latest report by JLL CEE and Skanska, “FLEXcellent Working”.

“The real estate market has been affected by the current Covid-19 situation and we see this particularly with its impact on the office occupational market. The wider use of home office working has changed the mindset of companies which are now rethinking the needs of their employees. At the beginning of the pandemic crisis, it was the Flex Office sector that demonstrated the first slow-down, however now we see that these Flex Space operators are likely to be among the best prepared for the requirements of corporate clients and their new strategies. Flex Space is able to offer a fully-fledged workplace and the required flexibility in these uncertain times. Flex Space offers different new types of memberships (rotated membership etc.) enabling companies to easily adapt to the change in office use. We are also seeing developers respond to the new trend by considering the opening of their own Flex centers within their latest projects”, comments Silvie Dudychová, Flex Space Consultant, JLL Czech Republic.

Flex solutions´ growth driven by corporations

Originally, the flex offices used to be options for freelancers, start-ups and small & medium businesses. However, the exponential growth of this sector in the past few years is tied to demand from corporate clients. Flex operators have started to design their spaces for enterprise clients. The layouts include larger office suites, the contracts are more negotiable, and the IT and security solutions are more sophisticated. Due to current economic downturn, the flexible solutions are expected to rise as their essence better fits with the changing requirements seeking shorter and more agile commitments.

“We have encountered a growing interest in “dual or hybrid solutions” when corporate clients complement traditional office space with a flex solution in the same building or nearby to support any potential growth instead of inserting expansion clauses into their lease agreements. To accommodate such demand, we reserve up to 25% of space in our office buildings to flex office operator. On the top of that, we invested our own capital into Business Link, a premium flexible space provider in Poland and in the Czech Republic, whose 100% share we acquired in 2019,” says Alexandra Tomášková, Executive Vice President for Hungary and Czech Republic at Skanska’s commercial development business, and continues: “The interest in more agile real estate solutions and possible reduced demand for long-term lease contracts will be reflected in the growth of flexible spaces. The role of offices has been changing and will certainly evolve.”

“Combination of traditional offices and flex space can be a very efficient solution for a company. In our view, the office buildings management will take over some hospitality aspects. And this will become key factor for keeping high interest and occupancy of an office space in the future,” adds Jana Prokopová, Leasing & Asset Manager at Skanska Czech Republic.

“Plug-and-play simplicity and convenience are the most crucial advantages that are offered by flex solutions. Companies may sign simplified agreements for certain number of working seats in standard as well as rotational model and move in on the very same day, providing a real kick-start to their work. Then, they may boost innovation through exposure to new concepts and ideas provided by a unique tenant-mix, composed of start-ups, SMEs, corporates, professionals, and freelancers,” comments Jana Gerhátová, Customer Care Manager, Business Link Czech Republic.

Not only in the office buildings

Now, more and more restaurants are looking to build on this set-up by formally getting involved in the coworking scene. This trend is most common in the United States, where, for example, KettleSpace already operates 16 locations across New York City. Another alternative to complement the offer is to locate flex spaces in shopping malls. Retail schemes have parking spaces, food courts, Wi-Fi, convenience stores – everything that a business requires.

Hotels also want to be part of this sector as well and are offering flexible office solutions. Lifestyle brands (e.g. Schani in Vienna or The Student Hotel in Amsterdam) offer workspaces comparable to the most recognisable global brands, such as WeWork or Spaces. Other hotel chains have decided to work with flexible office providers. For example, AccorHotels and WOJO have already jointly opened 12 flex spaces (nine in Paris and the Paris region, two in Lyon and one in Barcelona), and by 2022 plan to have 50 WOJO sites across Europe.

Flex office market in the Czech Republic

“The unprecedented growth of hybrid offices has been monitored since 2015/2016 in particular in Prague as the largest and most active office market in the Czech Republic. At the end of Q3 2020, the flex office market reached almost 77,000 sqm of flex space, i.e around 3% of total office stock in Prague,” says Blanka Vačkova, Head of Research at JLL Czech Republic.

In Prague, there are currently 68 centres in operation, out of them 23 facilities are located in the city centre. Other popular locations include Prague 5, Prague 8 and Prague 7. In terms of submarkets, the majority of flex offices is located within key business districts that are in the inner city (56%) and in the city centre (38%).

At the moment, the largest flex office operators on the Prague market are: IWG (28% of the total flex stock), Scott & Weber (13%), HubHub (8%), WeWork (8%) and Business Link (6%). IWG (with its Regus brand) and Impact Hub are the only operators, which have their operations in Prague, Brno and Ostrava, the three largest flexible office markets in the Czech Republic.

Legend: Serviced offices = up to 90% private offices, Coworking = approx. 80 % open plan office, Hybrid offices = 80 % private offices + 20 % coworking

Source: FLEXellent Working, Report JLL and Skanska, November 2020