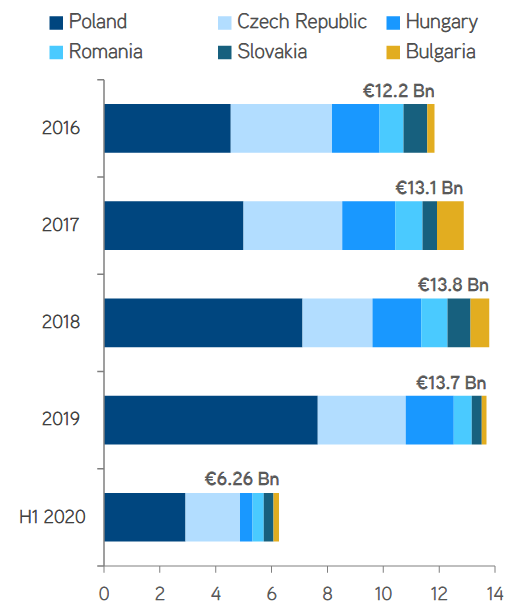

CEE Investment volumes for the first half of 2020 have increased year on year by 7%

CEE Investment volumes for the first half of 2020 reached ca. €6.26 billion. This figure was boosted by 2 large portfolios totaling in excess of €2.2 billion, with Poland and the Czech Republic taking a 78% share of the CEE-6 total.

The large residential portfolio transaction by Heimstaden represents 67% of the total volume traded in the Czech Republic and ca. 21% of total volumes. The acquisition of the 61.5% GTC shares from Lonestar by Optima across CEE represents 15% of total CEE6 volumes.

Aside from the large residential portfolio traded, the Office and the Industrial & Logistics sectors both performed well with 41% and 22% of the volumes.

Kevin Turpin, Regional Director of Research | CEE adds: “Unsurprisingly, the Retail and Hotel sectors remained somewhat more limited in activity, being among the hardest hit sectors by the pandemic. In terms of pricing, Prime Industrial and Logistics yields have remained stable, with some compression in select markets. Prime Office yields have moved out on average by 25 bps while prime retail has moved by 50 bps. Investor appetite remains strong for CEE but a cautious approach is still being applied while markets try to settle and travel restrictions still apply from some parts of the globe.”

“We remain hugely positive about the investment market climate in the Czech Republic. We have had detailed conversations with a very significant tranch of the active local and international investor universe over recent weeks and the one thing to take out of these discussions is that these investors remain extremely keen to secure opportunities,” says Andy Thompson, Director for CEE Investment Services at Colliers International

CEE Investment Volumes by Country 2016–H1 2020 (€ billion)

EMEA investors (excluding CEE) have been the most active during H1 2020, particularly Sweden with the large €1.3 billion Czech residential portfolio, followed by German and French capital, each with ca. €250 million of acquisitions. As in previous years, CEE domestic capital was also very active securing a third of all volumes.

The report can be downloaded from the Colliers International website here.